Credit clarity: 2.7 million Australians say they’re better off for knowing credit score

Millions of Aussies are making more informed choices about their finances thanks to understanding their credit score, according to new research by Finder.

A Finder survey of 1,090 respondents – 332 of whom know their credit score – revealed nearly half (45%) say it helped them to make better financial decisions.

That's equivalent to 2.7 million Australians who say they're better off financially by knowing their score.

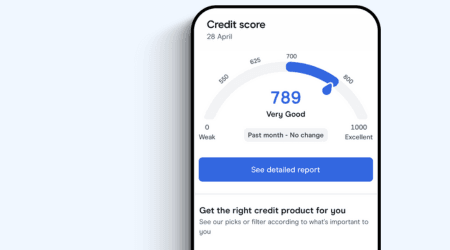

Your credit score is a number between 0 and 1,000 that lenders use when deciding whether to give you a loan or credit card. In other words, it's a number that demonstrates your reputation as a borrower.

The higher your score, the more likely you are to be approved.

Angus Kidman, personal finance expert at Finder, said knowing your credit score is crucial.

"Your credit score is a measure of how well you're managing your money.

"If you're planning a significant purchase, such as a home or a car, or if you're thinking about applying for a credit card, your score is a vital part of the process.

"It can help you negotiate the best possible interest rate and loan terms."

This has been the case for 1 in 10 (10%) knowledgeable Aussies who said understanding their credit score helped them to secure better loan terms with their provider.

Finder's data shows 15% of those who know their credit score say they are now better at paying their bills on time and in full.

The same number (15%) have been able to budget more, so that they can take out smaller loans.

Kidman said the good news is that it's easier than ever to check your credit score.

"You can check it for free in the Finder app in about 3 minutes.

"Data from our Consumer Sentiment Tracker shows the average Australian is doing pretty well, with a score of 700.

"If your score is lower, you may have to save for a higher deposit or factor in a higher interest rate. You can improve your score, but that does take time.

"It's a good idea to know where you sit well before starting a conversation with your lender," Kidman said.

| Has knowing your credit score helped you make better financial decisions? | |

|---|---|

| Yes, I actively worked to improve my credit score | 17% |

| Yes, I budgeted more so that I could take out a smaller loan | 15% |

| Yes, I am better at paying my bills on-time and in full | 15% |

| Yes, I negotiated better loan terms with my provider | 10% |

| I don't know | 9% |

| No | 46% |

| Source: Finder survey of 332 respondents who know their credit score, June 2023 |

Check your credit score for free here.