Budget Direct Building Insurance

Get 15% off

Finder's Top Pick for Most Popular

Finder's Top Pick for Most Popular

- Fire, storm & theft cover

- Lodge a claim online 24/7

- Optional sum insured safeguard

For a house valued at $1 million, our research showed a difference of $1,996 between the cheapest and most expensive home insurance policy. Compare policies and see how much you can save.

As someone building a house I can't stress enough making sure you get building insurance. The cost of materials has gone up significantly and big ticket items like retaining walls and driveways cost tens of thousands of dollars. I have peace of mind knowing that I'm covered for the investment.— Aaron McAllister, utilities publisher

Building insurance protects the physical structure of your property from financial loss. The policies are designed to cover your residential home, including flat units, townhouses, terrace houses and free-standing homes.

While building insurance policies can vary, they'll usually cover these parts of your home.

Insurers have a set of defined events where, if they occur, you should be covered. These include:

![]() Storms

Storms

![]() Lightning

Lightning

![]() Fire

Fire

![]() Cyclones

Cyclones

![]() Theft and burglary

Theft and burglary

![]() Vandalism

Vandalism

![]() Water damage/ escape of liquid

Water damage/ escape of liquid

![]() Impact damage

Impact damage

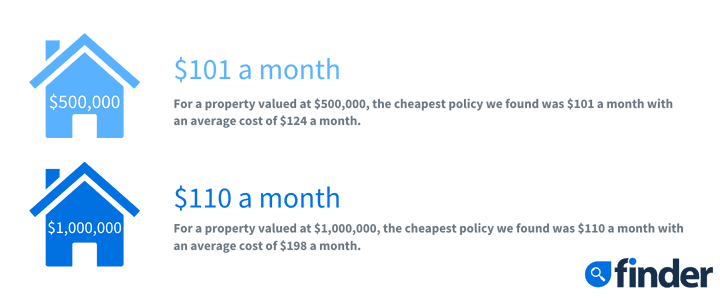

Well, we did some research and found that the cheapest policy was $101 a month.

Premium prices will change based on your individual circumstances, so while our research - from 17 home insurers, says the cheapest policy is $101, that was based on our criteria.

Make sure to get a quote (or multiple), so that you get the best value for your money.

| Brand | $500,000 Building - Monthly price | $500,000 Building - Annual price | $1,000,000 Building - Monthly price | $1,000,000 Building - Annual price | Get quote |

|---|---|---|---|---|---|

| $145.90 | $1,750.78 | $273.86 | $3,286.37 | More info | |

| $145.90 | $1,750.78 | $273.86 | $3,286.37 | Get quote | |

| $122.41 | $1,311.43 | $203.04 | $2,175.42 | More info | |

| $123.84 | $1,230.13 | $201.92 | $2,010.95 | More info | |

| $116.69 | $1,250.23 | $193.58 | $2,074.03 | More info | |

| $101.10 | $1,125.62 | $174.18 | $1,981.97 | More info |

| $120.97 | $1,451.69 | $159.77 | $1,917.18 | ||

| $135.54 | $1,355.42 | $219.07 | $2,190.70 | More info | |

| $110.16 | $1,321.88 | $110.16 | $1,321.88 | More info | |

| $138.02 | $1,401.40 | $200.68 | $2,054.50 | Get quote | |

| $139.22 | $1,434.56 | $202.18 | $2,057.17 | More info | |

| $143.02 | $1,415.42 | $202.46 | $2,075.05 | More info |

| $113.11 | $1,300.21 | $136.30 | $1,578.56 | More info | |

| $112.00 | $1,198.00 | $187.00 | $1,999.00 | More info |

| $155.84 | $1,582.35 | $226.58 | $2,319.80 | More info |

| $103.73 | $1,111.32 | $172.07 | $1,843.59 | More info |

| $113.06 | $1,221.05 | $154.02 | $1,663.41 | Get quote |

It's easy to get overwhelmed by a insurers product disclosure statement (PDS). We've explained a few insurance terms so you can understand your building insurance policy a bit better.

| Term | What it really means |

|---|---|

| Defined events | These are the events that your insurer will cover you for, if they occur. They'll be specified in your PDS. Common insured events that most policies cover include storms, fires and thefts. |

| Accidental damage | Accidental damage is when something unexpected happens to your house or belongings that causes financial loss. This is usually offered as an optional add-on to your home insurance policy. |

| Sum insured amount | This is usually the value of your property, and the maximum payout you'll get from the insurer. You'll declare this amount to your insurer, and that's how much money you'll get back if you lose your property to an insured event (minus any excesses). |

| Safety net | Some home insurers offer a buffer (safety net) if your sum insured amount isn't enough to cover the damages or losses to your home. |

| Total replacement | Some home insurers offer to cover you for the total amount if you lose your home. It's a benefit only offered by a few insurers and can help you avoid underinsurance. |

Having the right level of protection in place can save you thousands of dollars in the long run. However, some estimates suggest that as many as 80% of Aussie's are under-insured. Whilst it may seem appealing to cut costs at first, the risk of not having enough cover in place is not worth it.

The building insurance policy you take out should cover the total replacement cost of your property, including other expenses which may arise such as temporary accommodation. If you're under-insured, you'll have to pay the gap between what your policy covers and the replacement cost for your building, which in many cases could be a substantial amount of money.

The building insurance policy you take out should cover the total replacement cost of your property, including other expenses which may arise such as temporary accommodation. If you're under-insured, you'll have to pay the gap between what your policy covers and the replacement cost for your building, which in many cases could be a substantial amount of money.

Buying your policy online can save you heaps. Here are some promotions available at the moment.

Compare building insurance policies

Picture: GettyImages

You can soon get 4K Kayo, but for more than you pay now.

By reducing your interest rate you could save $231 a month. But there's a way to save even more than that in the long term.

These are the 7 best budget portable air conditioners available right now in Australia.

Australian investors should take a note on S&P 500's record highs influence on the ASX 200. Here's what you should know about it.

Your guide to the key factors affecting the AUD to INR forecast for the year ahead.

Steps to owning and managing Ram Essential Services Property Fund shares.

Banish those post-Christmas blues with an affordable getaway over the long weekend.

Find out where you can pre-order the Samsung Galaxy S24 phone range in Australia right now.

Millions of pet owners watch their animal over a video camera while they're out of the house, according to new research by Finder.