What is home equity?

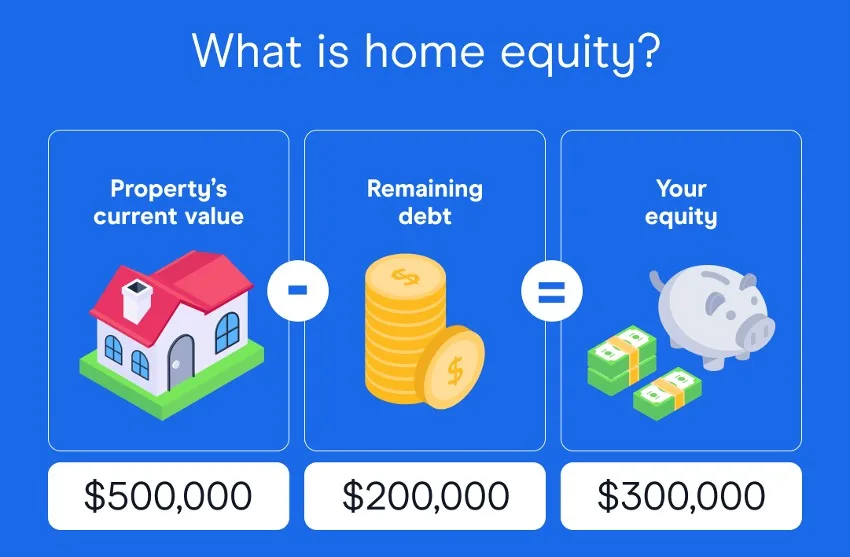

Home equity is the amount of the property you own once any mortgage debts are subtracted. And you can use this equity in several ways.

How much equity do I have in my home?

Equity is the value of your property minus any debts. It's the amount of the property you own and is expressed as a dollar value. Here's a simple example:

- Your property is valued at $1,000,000.

- You have $700,000 remaining on your home loan.

- The property value minus debt = $300,000 in equity

Your home equity in this scenario is $300,000. Now, equity calculations are always hypothetical to some degree. The value of your property changes over time and you can't really know what it's worth until you sell it. And these quick calculations don't consider things like selling costs (real estate agent commissions, conveyancing fees etc).

Here's a simple visual explanation of the concept of home equity.

Over time, your equity should grow as you pay off your debt. The other factor affecting your home equity is the property's value. In a rising market, your equity increases by itself as the value of the property grows.

Property owners can use their home equity through line of credit loans or other loan products. This allows you to borrow against the equity to fund investment property purchases, renovations, retirement costs and more.

How do I calculate my home equity?

The calculation, as explained above, is simply the property value minus any debt on the home. You can use this simple calculator to estimate your equity. Just enter the following information:

- An estimate of what your property is currently worth.

- How much of your home loan is left to repay.

| Response | Female | Male |

|---|---|---|

| A better interest rate | 5.08% | 4.24% |

| Lower fees | 2.2% | 1.73% |

| To reset the loan term | 1.69% | 0.96% |

| A cashback or other incentive offer | 1.19% | 1.35% |

| Better/more features | 0.51% | 1.35% |

| Better overall cost | 1.19% | 0.58% |

| Other | 0.17% | 0.96% |

| To move to a different brand | 0.68% | |

| None of the above | 0.17% |

Estimated home equity<\/h3>Total equity: $" + totalString + "<\/h4>Usable equity: $" + usableString + "<\/h4>

Usable equity: $" + usableString + "<\/h4>

Useable equity is the amount of equity a lender will let you borrow. This is at most 80% of your total equity. The 20% buffer is to reduce the lender's risk.<\/p>