First homebuyer e-course

Sign up for our FREE 8-week course to get on the property ladder.

The cost of building a house varies significantly depending on the size of the property, the materials you use, the design of the home and the builder you choose. Costs also vary depending on where you live, with some cities having cheaper construction costs on average than others.

The HomeBuilder program, introduced when the pandemic set in, drove huge demand for construction and prompted building prices to soar. In fact, Master Builders Australia reported that during 2021, 4 out of 5 domestic home builders reported "significant delays" in being able to secure tradesman like concreters, joiners and bricklayers.

They also reported an increase of "up to 10% in the cost of materials and specialist trades or labour".

So where does that leave you if you're planning to build a home?

The variation in square-metre building costs can be huge, but ballpark figures can help you estimate the costs you're up for.

We've done some research to help you estimate your building costs and obtain construction finance.

According to BMT Tax Depreciation Quantity Surveyors, the following estimates could help you budget for a house build, based on 2021 construction costs:

| Home size | Low ($/m2) | Medium ($/m2) | High ($/m2) |

|---|---|---|---|

| 3-bed home (single story) - weatherboard | $1,440 | $1,612 | $1,993 |

| 3-bed home (single story) - brick veneer | $1,535 | $1,709 | $2,041 |

| 3-bed home (single story) - full brick | $1,528 | $1,703 | $2,116 |

| 4-bed home (single story) - weatherboard | $2,041 | $2,159 | $2,696 |

| 4-bed home (single story) - brick veneer | $2,147 | $2,251 | $2,832 |

| 4-bed home (single story) - full brick | $2,437 | $2,784 | $3,024 |

| 3-4 bedroom, 2 story home | Add 5-10% to above estimates | ||

| Architecturally designed residence | $3,294 | $4,216 | $5,898 |

It's helpful to know the cost per square metre. But how big is the average house, so you can calculate your potential costs?

Australia builds some of the biggest houses in the world, bigger than the United States, reports the CommSec Home Size Report. Their research shows that the average new house built in Australia in 2019/20 was 235.8m2.

Based on the above estimates, this would put the average building price at:

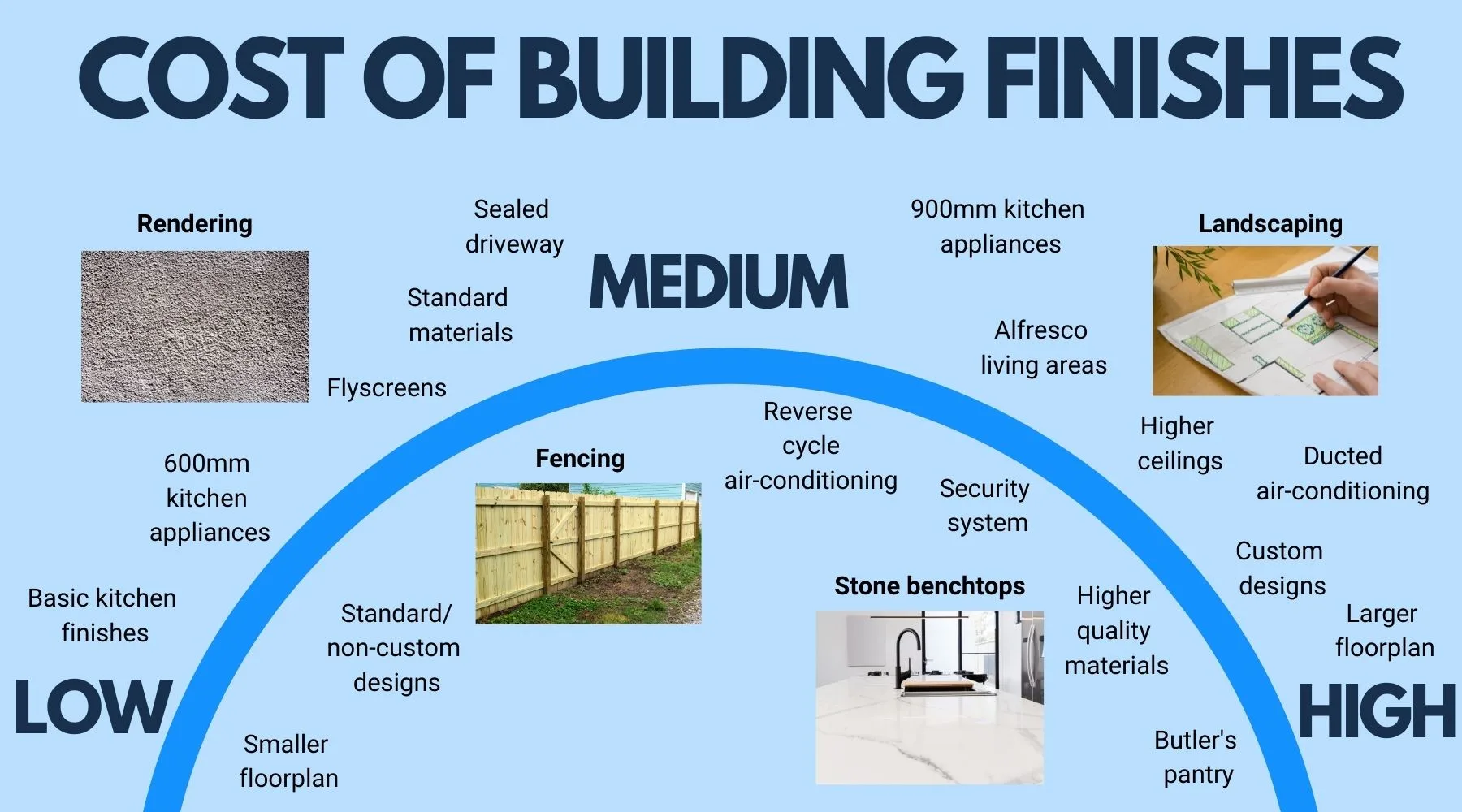

Nick Khachatryan, founder and managing director of Real Estate Exclusive and Jardine Nicholas Homes, says if you're looking to build a three-bedroom house, prices will vary widely depending on the standard of finish you choose for your home, as well as the inclusions you want and any other requirements specific to your build. As a guide:

| Response | 75+ yrs | 65-74 yrs | 55-64 yrs | 45-54 yrs | 35-44 yrs | 25-34 yrs | 18-24 yrs |

|---|---|---|---|---|---|---|---|

| Interest rate | 93.02% | 92.55% | 93.57% | 95.65% | 92.52% | 90.78% | 80% |

| Fees | 76.74% | 75.16% | 70.76% | 72.95% | 66.54% | 70.87% | 62.86% |

| Extra repayment | 34.88% | 39.13% | 39.18% | 33.33% | 25.98% | 28.64% | 25.71% |

| Lender reputation | 32.56% | 18.01% | 15.2% | 12.56% | 19.29% | 15.53% | 30% |

| Offset account | 32.56% | 37.27% | 40.35% | 46.86% | 50.79% | 44.17% | 22.86% |

| None of the above | 4.65% | 3.11% | 1.17% | 0.48% | 0.79% | 0.49% | 2.86% |

| Speed of approval | 2.33% | 6.83% | 11.7% | 9.66% | 10.63% | 9.22% | 21.43% |

| Wider eligibility criteria (e.g. self-employed docs) | 2.33% | 2.48% | 2.34% | 3.38% | 5.51% | 6.31% | 8.57% |

| Split accounts | 1.86% | 1.75% | 0.48% | 1.97% | 3.4% | 5.71% | |

| Other | 0.58% | 1.45% | 0.39% |

Land and location

"Land is the first prime factor in the overall cost of the home with respect to the budget and, in the majority of cases, will determine the budget for the house build," says Drewe McCredie, general manager of Brisbane-based construction and development company kalka. The nature of the block – is it flat or sloping, for example – will also affect the total cost. "Each state also has its own varied rates for taxes, insurances, and certification processes and fees. Building outside of a metropolitan area will also affect the cost for out-of-area allowances for additional travel," McCredie says.

Height

McCredie says that it will generally cost more to build a two-storey home than a one-storey home as there are additional items required to build a second-storey home, including an additional floor system, stairs, scaffold, fall protection equipment etc. that are not always required for a single-storey house build.

Materials

From brick and brick veneer to a lightweight clad such as weatherboard, the materials used in the construction of your home will have a big impact on the total cost. "The approximate costs of a brick veneer vs a fibre cement sheet clad are going to be about on par," McCredie explains. "The different range of bricks and also type of mortar colour will increase the cost of the brick component, and some bricks are approximately three times the cost of your entry-level brick. Lightweight cladding is also in a similar comparison."

Trades

Trades also play a part in the cost of your build. "Brick trades typically have different rates for upper or lower bricks, and also single- and double-height bricks. Lightweight-clad trades generally have a single rate for each cladding type," McCredie explains. Then there are the other trades you need to get your house to move-in status: plumbers, electricians, tilers, painters, plasterers, renderers and even landscape gardeners.

The builder you choose to complete your construction project is the next factor that can have an impact on the overall price. Builders can vary not only in the type of work they specialise in (for example, custom-built homes vs display homes), but also in how much they charge for their work. It's essential to obtain quotes from several builders to get an accurate idea of building costs, as well as which builder offers the best value for money.

Nick Khachatryan says that the majority of home builders simply pursue the cheapest quotes, which often ends in disappointment. "The best way is to look at the builder's price compared to others' prices and the inclusions list from the core of the house to the ceiling. Keep a lookout for site costs as they can vary from builder to builder; however, do not pursue the cheapest site cost quote – very often you will be asked to pay the difference in the future."

If you're looking for a low-cost option when building a house, you might want to consider a kit home. These homes are designed and built off-site, and then the materials are delivered by truck to your block of land for assembly.

Below are some rough guides to how much it costs to buy a kit home. We've taken prices from multiple products from two Australian kit home companies. These prices do not include costs for delivery and assembly.

| Number of bedrooms | Lowest kit price | Highest kit price |

|---|---|---|

| 2-bedroom kit home | $26,632–$39,510 | $79,568–$106,890 |

| 3-bedroom kit home | $38,711–$70,030 | $92,151–$193,890 |

| 4-bedroom kit home | $55,268–$95,880 | $117,570–$216,760 |

Sources: Prices come from iBuild and Prestige Kit Homes, November 2021

Kit homes can be cost-effective, allowing owner-builders to do much of the work themselves, and come in a wide range of designs. However, there are several factors that can affect the cost of a kit home.

The answer to this question depends on a range of factors. For example, getting a builder to put the kit home together will cost a lot more than if you do most of the work yourself, but you also have to consider the cost of paying various trades (plumbers, electricians) to get your home to the point where it's ready for you to move in.

The key to deciding whether a kit home is the most affordable option for you is to make sure you're fully aware of what is included in the package and what you will have to pay extra for? You may need to pay for soil testing, laying slabs and any finishes you add yourself.

And if you opt for a kit home, you may have trouble accessing the financing you need from your bank. Australian lenders take a very conservative approach to kit homes because if something goes wrong during the construction process, lenders could be left with only a vacant block of land as security. As a result, the majority of lenders won't approve loans to owner-builders who want to construct a kit home, while those that do offer approval will impose tight restrictions on the loan to value ratio (LVR) they are willing to let you borrow.

If you need to borrow money to build your home, you'll need to apply for a construction loan. These loans can be set up to allow you to purchase a vacant block of land first and then build on that land within a set timeframe or to fund the construction of your home if you already own the land.

Unlike a regular mortgage, where the lender gives you access to a big lump sum when you take out the loan, a construction loan is set up a little differently. The lender calculates the total amount you will need to borrow to pay your builder, and then allows you to access portions of this amount at specified times so you can pay your builder throughout the construction process. These loan withdrawals are known as progress draws and are a predetermined percentage of the total mortgage amount.

The lender will typically set a timeframe, such as one year, for the construction of your house and probably only require you to make interest payments while your home is being built. Once construction is complete and the builder has been paid, you will start making full principal and interest repayments.

You can learn more about construction loans here or start compare loans in the table below.

Historic data and expert opinion suggests that even in the event of a recession, Australian property prices might actually rise.

Chris Gray takes us through four things people get wrong when buying property.

Auction expert Damien Cooley gives the lowdown on why property auctions are the best way to sell right now.

Richard Holden from UNSW Business School delves into Australian home loan sizes and rate cuts

We can't make clear predictions about Sydney's property market, but here's what the data suggests.

There's profit to be made in renovating your home, but don't jeopardise your insurance when you do.

Working out how interest is calculated on a home loan can help you determine your repayment capabilities and how to pay it off sooner.

Australians are now drinking less than we previously were. Find out how you could save $40,000 by simply not drinking alcohol.

Guarantor home loan options can help you buy a home, with a family member acting as a guarantor on your home loan. Learn how it works and if you qualify.

What is an offset account? It can save you thousands in interest and help you own your home sooner.

Sign up for our FREE 8-week course to get on the property ladder.

Get a home loan with a low deposit.

Pay less for your home loan with a super-low interest rate.

Save on your investment loan with these hot offers.