ING prepares to launch first credit card

ING aims to bring something new to the credit card market.

ING Direct is preparing to jump into the credit card ring with the launch of its Orange One credit card this year. While ING hasn’t released any of the specific card details, including the annual fee or interest rate, it has dropped some hints as to where it’ll fit in the market.

Apparently, ING told The Australian that it aims to offer a card that’ll suit the discontented among its competitor’s customers. While this vague comment doesn’t give too much away, it could suggest that ING Direct’s first credit card will boast competitive interest rates or low annual fees to help suit customer’s financial needs while keeping costs to a minimum.

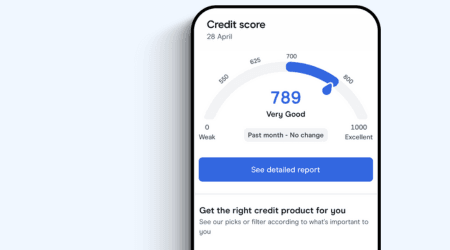

ING has suggested it’ll also be designed to suit the digital natives of the world. As well as meeting customer’s financial needs, ING has also hinted that the card will come with digital and online capabilities. The ING Direct mobile banking app is already available to existing customers and no doubt they will update its functionality to support new credit card customers. As ING partnered with Apple Pay for its debit card in February and Android Pay last year, we can assume that the card will come with Apple and Android tap-and-go technology, as well as Visa payWave.

ING isn’t the only provider who has responded to sentiments of disillusioned credit card holders this year. In February, ANZ reduced rates on its Low Rate and Platinum cards, while Westpac has hinted at the launch of a new credit card with a single-digit purchase rate. Following pressure at a Senate Inquiry last year, we predict that more of the big banks will follow suit and drop their rates in the coming months.

While the Orange One credit card was launched to a small group of existing customers in November 2016, it won’t be available to the public until later this year. While ING has mainly been focused on mortgages, deposits and savings accounts, the addition of credit cards and personal loans is a milestone for the company.

Make sure to check back with finder for more information on ING's new credit card as it comes.

Latest credit cards headlines

- Business statistics Australia

- P&N Bank & Visa Platinum Credit Card

- Credit Union SA Workplace Benefits Credit Card

- 3 ways to deal with a New Year debt hangover

- AFCA received over 100K complaints last year. I was one of them

Picture: Shutterstock