Peer-to-peer (P2P) lending is also known as marketplace lending. It is when loans are financed by multiple investors. It cuts out middlemen like banks, building societies and credit unions and takes you directly to the investor. P2P loans feature access to potentially lower rates and comparatively relaxed lending criteria. Some P2P lenders even offer personal loans.

What is a P2P loan?

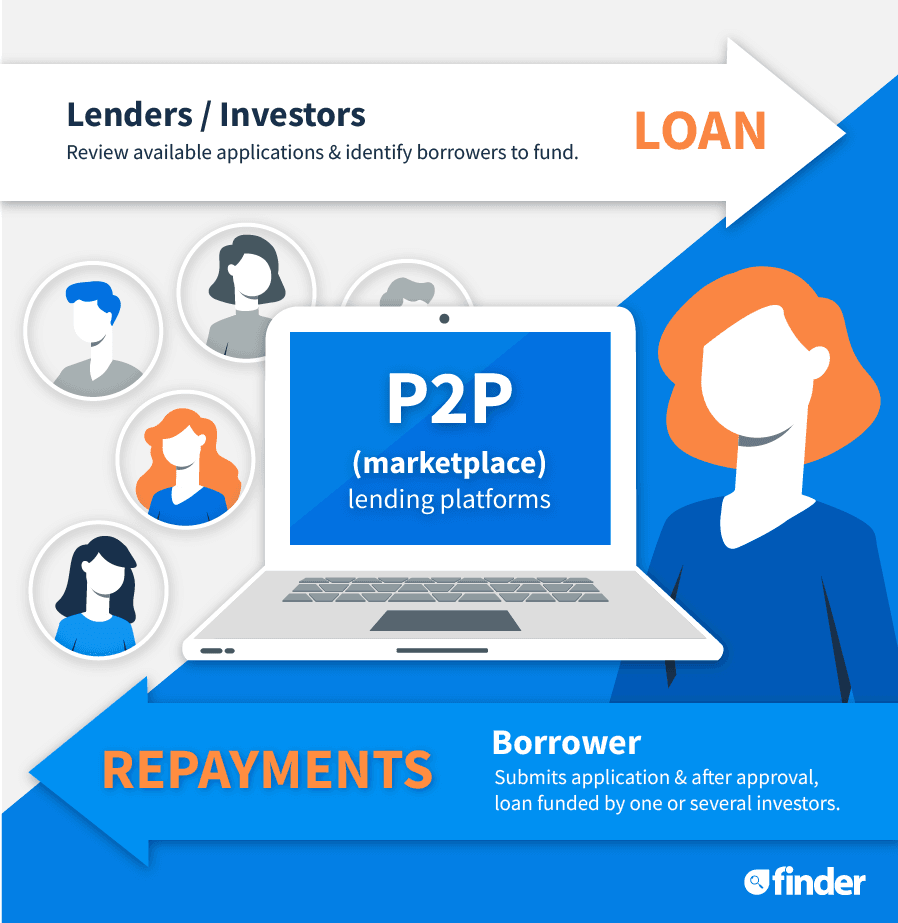

A P2P loan is when you borrow money from individual investors. P2P lending sites match investors to borrowers.

The “lender” acts as a facilitator for the loan and operates the online platform where the applications are made and the matching takes place. It acts as the intermediary between the borrower and investor. The lender charges fees both from the borrower and the investor.

In return for lending money, the investors may get higher returns compared to what they get from other investments. Borrowers can get lower-interest loans.

Unlike traditional lenders, P2P lending has a more flexible lending criteria. This means that lenders are more open to funding loans for borrowers with less than perfect credit scores. They do this by offering interest rates personalised to the borrower and their risk profile. Excellent credit borrowers can receive lower rates and average credit borrowers will have access to finance but at a higher interest rate.

How does P2P lending work?

P2P or marketplace lending takes place on an online platform. Loan requests are made online, and these requests may be matched to investors.

While P2P lenders match borrowers to investors, they don’t match individual lenders to individual borrowers. Most often, the investor invests in a portfolio of consumer loans facilitated by the lender.

It is basically an investment or managed fund, with the lender acting as the fund manager. Investors can choose to invest in certain types of loans, for example, personal or business loans, or they are matched to loans that meet their criteria. For instance, loans within a certain interest rate range or loan term.

P2P lending offers personalised or risk-based loans. At the time P2P lending was introduced in Australia, this form of lending was a novelty. To remain competitive, traditional lenders have responded with their own risk-based loans. They are increasingly offering more competitive rates and innovative technology.

💲 If you’re looking to borrow, you’ll first have to submit an application to the lender. The lender will evaluate your eligibility by verifying your identity, credit history, employment and financial details.

Based on your risk profile, the lender will then give you a personalised interest rate. The lower the risk of lending, the better your rate will be.

After approval, your loan will be funded by one or several investors that choose to take you on. The P2P lender will usually deduct an application fee from the amount transferred.

💵 If you’re looking to invest, you may be able to choose how your money is used. You could choose to invest in a portfolio of loans or you could fund an individual loan.

You’ll be able to review applications on the website and identify the loans you’d like to fund. You can choose to provide partial or full funding. However, you will not be able to see the borrower’s personal information.

Once you’ve agreed to fund a loan, the money will be transferred to the borrower. Repayments will be made based on how much of the loan you’ve funded.

The ins and outs of P2P loans

Government Guarantee

The Government Backed Guarantee on Deposits was set up to protect investments up to $250,000. They do not apply to funds in peer-to-peer lending as it only applies to institutions authorised by the Australian Prudential Regulation Authority (APRA).

What are the benefits and drawbacks of P2P loans?

Like all loans, P2P loans have benefits and drawbacks you need to consider.

For borrowers:

- You may be able to get a loan at a rate lower than those offered by traditional lenders.

- The application process is speedy and entirely online.

- Most lenders offer lower loan amounts than banks. It is usually up to $35,000 for a personal loan.

- The loan may come with fewer features than traditional personal loans.

For investors:

- A higher return on funds compared to other forms of investments.

- The opportunity to diversify your investments. You can also spread your funds over several loans to minimise your risks.

- There is no government-backed guarantee on the funds you invest.

- It can be a risky investment.

Which lenders offer P2P loans in Australia?

There are a number of P2P lenders in Australia. They offer their own unique product and rate. The table below is a quick guide to Australia’s P2P lending landscape:

| Peer-to-peer lender | Type of loans offered | Loan amount | Loan term | |

|---|---|---|---|---|

|

Business loans |

$100,000 up to $10,000,000 | 3 to 5 years | ||

|

Personal loans |

$5,000 to $80,000 | 3 to 7 years | ||

|

Personal loans |

$5,000 to $50,000 | 12 to 84 months | ||

|

Personal loans |

$5,000 to $50,000 | to | ||

|

Business loans |

$50,000 to $300,000 | 1 year and 5 years | ||

|

Business loans |

$30,000 to $500,000 | 1 to 5 years | ||

|

Bigstone |

Business loans |

$10,000 to $5,000,000 | 12 to 60 months | |

|

Personal loans |

$5,000 to $62,000 | 3 to 7 years |

How do I compare my options?

Whether you’re a lender or a borrower, there are a number of factors to keep in mind when comparing lenders. We’ve listed them below:

|

Compliance |

✔️ Before either borrowing or investing, you should check the credibility of the lender. |

|

|

Rates |

✔️ P2P lenders generally offer rates lower than those offered by banks. |

✔️ You should look into how the interest rate is set and who decides the rate. |

|

Fees |

✔️ Apart from paying interest, you will also have to pay fees. This can include establishment and monthly fees. These fees should be included in the comparison rate. The comparison rate is the total cost of the loan, interest and fees included. You should make yourself aware of all fees involved as this will increase the cost of the loan. |

✔️ While you’re receiving a return on investment, you will also have to pay the operator fees. You should look into whether they charge for you to invest, for handling repayments and for you to access your money early. |

|

Loan terms and amounts |

✔️ How long do you have to repay the loan? Are these terms adequate for you? You should check if you’re able to borrow for as long as you need it. |

|

|

Reputation |

✔️ The lender’s reputation should form part of your comparison. |

✔️ You should consider the lender's track record, including how it assesses borrower risk. |

|

Features |

✔️ What features are you looking for with a personal loan? Do you want a secured or unsecured loan? |

✔️ You should take the time to read the product disclosure agreement to understand what you’re getting into. |

|

Repayments |

✔️ The first thing you need to consider is whether you can afford the loan. To know this, you’ll have to look into how much your repayments cost. |

✔️ How long will it take for a return on investment? Are the terms too long for you? |

|

Requirements |

✔️ As a borrower, you will have to look into whether you’re eligible to apply for the loan. |

✔️ All lenders are required to perform background checks on borrowers. |

|

Risk |

✔️ You should look into whether the lender is too relaxed about borrower eligibility. |

Which P2P loan is the best?

There isn’t a single loan that can be considered the “best” personal loan. What’s best for one borrower may not be the best for another. The best P2P loan for you will depend on your needs and circumstances. For instance, you may prioritise some aspects of the loan, such as cost, over other aspects, such as features. In instances where your score isn’t perfect, you’ll have to look for the best loan from the options available to you.

We’ve created a list of things to consider when looking for the best personal loan:

- Does this loan fit my budget? Look at the interest rate, but also the comparison rate to determine the true cost of the loan. If it fits comfortably within your budget, the loan may be worth considering. A loan with low rates and fees would be a good find.

- Do the loan features meet my needs? Consider whether the loan is secured or unsecured. Look whether the interest is fixed or variable. Are there any other additional features? Once you understand the features, you can determine whether the loan is suitable.

- Do the loan terms meet my requirements? Is the loan term too long or too short? Will a longer term make the loan more expensive? Will you have difficulty meeting repayments if the term is too short?

- Is the loan amount enough? Does the loan amount cover your needs or will you need a larger loan?

- Can I comfortably make my repayments? Is the repayment cycle aligned with your pay cheque? Will you be left out of pocket or scrambling to make your repayments?

- Does the loan require an asset as security? Do you have an asset to offer as security? Are you comfortable with the risk of a secured loan? Would you like lower rates by offering security? If you don’t have an asset to offer, you should consider an unsecured loan.

Should I apply for a P2P loan with bad credit?

Before you apply for a loan, you need to know what your credit score is. You can get a free credit check with Finder. This will give you an idea of where you stand on the credit scale. You could have a few negative marks, but there may be a chance you’ll fall into one of the lender’s brackets.

That said, you need to thoroughly research your lenders. Some lenders offer loans based on a “best”, “good” and “average” scale. Other lenders have tiers ranging from 1 to 5. This can range from exceptional to excellent, very good, good and average.

Lenders ultimately rely on information supplied by credit reporting agencies. In Australia, there are 3 main agencies: Experian, Equifax Australia and illion. The scores can range from 0 to 1,000 for Experian and illion, and from 0 to 1,200 for Equifax Australia. Because of the difference in scales, your score could differ between credit score providers. Lenders like SocietyOne base their calculations on scores provided by Experian. If you know where you stand on Experian’s scale, and if you fall into one of the lender’s tiers, you could be eligible even if you have some negative listings.

Checking your score before applying can help you determine whether you’re eligible. If you don’t fall into the lender’s eligibility categories, you shouldn’t apply. All credit applications are listed on your credit report. If a lender rejects you, this can affect your credit score, which will make it harder to apply for credit in the future.

If you have bad credit and need a personal loan, you should work towards improving your score. Your credit score is updated every month. What you do to improve it now will have an impact in the long run. Some of the steps you can take to improve your credit score include the following:

- Paying all your bills on time

- Paying off your debt

- Lowering your credit card limit

By demonstrating that you’re willing to engage in positive credit behaviours, you can increase the lender’s confidence in you.

Why compare personal loans with Finder?

We're free

Our personal loan comparison is completely free to use. There are no costs at all for you to use our database to find a better deal. Better still, we regularly run exclusive deals that you won't find on any other site.

We're experts

We've researched and reviewed hundreds of loans as part of our Finder Awards. Our database and tables are always up-to-date and our in-house experts regularly appear on Sunrise, 7News and SBS News.

We're independent

We are independently owned and have a mission to help Australians make better financial decisions. That means our opinions are our own and you can compare nearly every personal loan in Australia (and find a better deal).

We're here to help

Since 2014, we've helped 300,000+ people find a personal loan by explaining your options simply. You don't need to give us any details to use our comparison. We're here to help you make a decision.Frequently asked questions

More guides on Finder

-

Personal loan rejection: Reasons and how to avoid it

There are a number of reasons why your personal loan application may be rejected.

-

Guarantor personal loans

If you don't quite meet the criteria for a personal loan, applying with a guarantor can help get your application over the line.

-

What is the minimum income for a personal loan?

Not sure how much you can borrow based on your income? If you're looking for a personal loan, find out how lenders determine how much you can borrow and how to see if you're eligible based on your income.

-

Personal loans for new employees

Just started a new job but need money straight away? You can apply for a personal loan with selected lenders now.

-

Personal loans for self-employed borrowers

Find out what personal loan options are available to you as a self-employed person and how you can be approved.

-

How to Transfer Your Personal Loan to Another Bank

How you can save by switching personal loans.

-

How much is your dog really costing you?

A dog can add a lot of value to your life. Find out the real cost of getting a pet and if you can afford it.

-

How do personal loans work?

Personal loans can be complicated, but we've simplified the process for you so you can focus on finding the best deal.

-

Easy personal loans

Not all personal loans come with endless documentation. Some lenders specialise in quick and easy application processes.

-

Loans for casual and part-time workers

Find out your loan options if you're casually employed, or are part time and don't work a full 40-hour week.

Ask an Expert

I am awaiting an inheritance settlement in approximately 90 days, but I will have nowhere to live anymore starting next week, can someone help me secure a loan of approximately 3,000-5,000 dollars so I can secure accommodation for the next 3 months? I will happily repay 7,500 come July.

Hi Gareth,

To see what options you have with any providers listed in the table, simply click the green “go to site” button.

Or, you might be able to apply for a short-term loan – here are some options:

https://www.finder.com.au/short-term-loans

Keep in mind that these loans often come with higher interest rates and fees, so make sure you factor that into your calculations.

Hope this helps!

Hi Team i would like to apply for a combine ptop lone with my wife i have high credit score and 4 month’s working& Wife has average credit score but 2 pluss years in job is this possible please.

Hi Cristopher

Thanks for getting in touch! To apply for a peer-to-peer personal loan, check the eligibility criteria of the loan before applying to increase your chances of approval. Read up on the terms and conditions and product disclosure statement and contact the bank should you need any clarifications about the policy.

Our page shows a list of P2P lenders. I also suggest reading the part on the page that says “How do I compare my options?” to help you decide which lender to go for!

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Best,

Nikki

Hi Team,

I would like to invest in a P2P loan.

Is this possible if I am not an institution?

Do I need to be a ‘sophisticated’ investor?

If not, which P2P lenders will allow me to make an investment?

Thanks!

Sammy

Hi Sammy,

Some P2P lenders require to you be a sophisticated investor while others allow non-sophisticated investors to lend. Here are the requirements for some prominent P2P lenders:

– SocietyOne: Need to be a sophisticated investor

– RateSetter: Individuals over the age of 18 can lend from just $10

– MoneyPlace: Currently need to be a wholesale or institutional investor, but retail investors are coming soon

– Harmoney: Currently only sophisticated investors can apply, opening to retail investors soon

– Marketlend: Open to retail investors

Hope this helps,

Elizabeth

Do you have a comparison page for investors? Specifically I want to know which platform and investment has the lowest default rate.

Hi J,

Thanks for your inquiry.

I believe when you said investor, you mean you’re looking for business loans. If this is correct, please check our list of business loans. On this page, you’ll read more details about business loans, how to apply, and compare your options.

I hope this helps.

Cheers,

Danielle

I am looking at investing in buying a 20 year lease on a Holiday Park which has excellent proven turnover of a million plus per annum and approx six to seven hundred thousand profit after running costs and GST. The problem is that they are asking for $1,250 000.00 up front. I am unable to borrow that much from a bank as I don’t have that much security to cover it. Do you know of any business that could assist me in obtaining this amount of money. I would be asking for a 5 to 7 year loan to pay it back with interest of course.

Thanks

Ian

Hi Ian,

Thanks for your question.

You can take a look at our business loans guide that also provides you with a few options but the maximum loan amount from the lenders available is $500,000. While you might not be able to provide security, you still might want to get in touch with banks, if you can provide a business proposal they may be able to offer you financing. You can also think about getting in touch with a business loan broker to help you source financing. The business loan guide provided in the link may offer some more guidance.

I hope this has helped.

Thanks,

Elizabeth

am joseph from kenya.my question is am i eligible for a loan of 500$ or its only citizens of australia who qualify alone.

Regards

Hi Joseph,

Thanks for your question.

You may be eligible for a loan from peer-to-peer lenders such as Society One, as they simply require you to hold an Australian bank account and be over the age of 21. For your other loan options, you can take a look at our guide to loans for temporary residents.

I hope this has helped.

Thanks,

Elizabeth