What does "interest-free days" mean?

Interest-free days are a common credit card feature that gives you a way to make purchases without being charged interest for a set number of days in each statement period. They begin on the first day of your statement period and end on the payment due date.

For example, with a credit card that offers up to 55 days interest-free, you would get the maximum 55 days for purchases made on day 1 of your statement period. And a purchase made on day 30 would give you 25 days to pay it off before interest is charged.

- Take note: Usually, you need to pay your credit card balance in full by the due date on your statement to make use of this interest-free period.

How do interest-free days work?

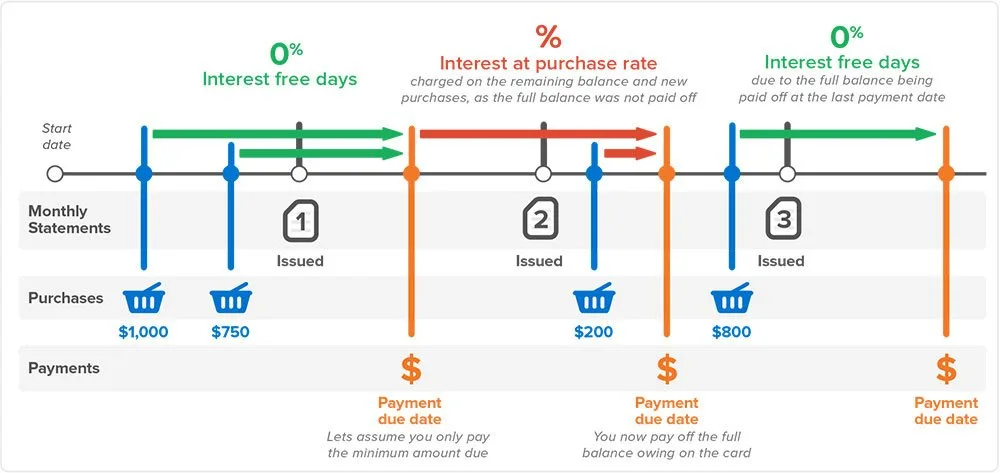

This visual example of interest-free days highlights the interest-free period (in green), when purchases are made, when the statement is issued and what happens if you pay less than the full amount for a billing cycle.

Find some of the terms confusing? We get it. Jump down to our definitions to learn more.

Example: How to use the interest-free period on a credit card

Say you had a credit card that offers up to 55 interest-free days, with a statement period that starts on the 1st of each month and ends on the 30th. If you were making purchases in June, here's how the time period would look:

- 1st June. First day of the statement.

- 30th June. Last day of the statement.

- 25th July. Payment due date for this statement period.

In this case, the 55 interest-free days begin on 1st June and end on the 25th of July. So, here's an example of how this credit card's interest-free period would work for your monthly purchases:

- You make a $200 purchase on 1st June. You don’t have to pay any interest towards this purchase until 25th July, which gives you 55 interest-free days.

- You make a $100 purchase on 20th June. This is the 20th day of your statement period, which means you get 35 days interest-free before a payment is due on 25th July.

- You make a $150 purchase on 30th June. This is the last day of your statement period but the purchase won't attract any interest until 25th July, giving you an interest-free period of 25 days.

In this example, you would have a credit card balance of $450 from new purchases on your June statement. If you paid the total amount owed by the 25th July, you wouldn't be charged interest on your purchases. You'd also get interest-free days for the next statement period.

I've paid no credit card interest for 11 years – here's how I do it

Key terms for interest-free days

- Statement period or billing cycle. The statement period shows activity on your credit card account and usually runs for 30 days, or from when your last statement was issued to when the next one is issued.

- Payment due date. This date is listed on your statement and tells you when you need to pay at least the minimum amount. If you want to get interest-free days, you'll usually have to pay the total balance by the due date.

- Closing balance or payment closing balance. The total you need to pay by the due date on your statement if you want to get interest-free days for the next statement period. A "closing balance" is usually the total of what's owed on your account, while a "payment closing balance" might be different if you have a promotional rate or offer for part of your balance.

- Minimum monthly payments. This is the minimum you need to pay by the due date on your statement to avoid late fees and a late payment listing on your credit report. You usually can't get interest-free days for purchases if you only pay this amount.

- Purchase rate. The interest rate charged on purchases. Interest-free days help you avoid this cost.

- Take note: Interest-free days only apply to new purchases, including groceries and retail shopping, petrol, travel bookings and even medical appointments. Transactions that don't typically qualify for this interest-free period include cash advances, balance transfers and BPAY payments.

Is a credit card with interest-free days worth it?

Most credit cards in Australia offer interest-free days on purchases, so it may not be the main feature you look at when comparing cards. But if you pay off your credit card balance in full by the due date each month, a card with interest-free days means you can make purchases without paying interest. This could be ideal if you use a credit card to earn rewards or for short-term cash flow such as spending between monthly paydays.

You could also use it as an alternative to buy now pay later services. But if you think you might not be able to pay the account's closing balance in full each month, you may want to consider low interest rate credit cards and 0% purchase offer credit cards.

Interested in other types of credit card interest-free periods? Check out credit cards with 0% interest rate offers for introductory deals and other options.

Finder survey: How long have Australians had their current interest-free credit card?

| 5+ yrs | 37.5% |

| 2 yrs | 27.94% |

| 1 year | 13.24% |

| 3 yrs | 13.24% |

| Less than 1 year | 4.41% |

| 4 yrs | 3.68% |

Source: Finder survey by Pure Profile of 1113 Australians, December 2023

Frequently asked questions

What is the maximum number of interest-free days I can get?

The humm90 Mastercard offers up to 110 days interest-free on all purchases (excludes cash advances). This is the highest number of interest-free days currently available on a credit card in Australia according to the Finder database.

In comparison, most other credit cards offer between 44 and 55 days interest-free, with a few also offering up to 62 days interest-free. These are also other cards that offer extended interest-free finance options with specific retail partners.

Do additional cards also get interest-free days?

Additional cards linked to your primary card follow the same billing cycle as the primary card and offer just as many interest-free days on purchases.

I can’t pay my account’s closing balance in full this month, but I can in the future. Will I ever get interest-free days again?

Usually, when you carry a balance over to your next statement period, you won't be eligible for interest-free days for that statement period. To get the interest-free period back, you'll need to pay the total amount listed on your next 1-2 statements by the due date. This does vary by card, so check the details for your account or ask your credit card provider what you need to do to get interest-free days again.

How do I get interest-free days?

You usually need to repay the full closing balance that's listed on your statement by the due date to get interest-free days. In most cases, you also need to pay the full balance for the previous statement, as well as the statement issued at the end of that period.

Compare 55 days interest-free credit cards

Back to top

Do any of the 55 days interest free credit cards require a monthly minimum spend?

There’s information about cash advances and making payments but I’d like to know if any credit cards require a minimum amount is spent each billing period (particularly if you plan to pay the balance by the due date?).

Hi Jenny,

Credit cards don’t require you to spend a minimum amount each month. So you could spend between $0 up to your available credit limit in a billing cycle. Just keep in mind there is a minimum repayment amount, which will be shown on each statement. I hope that helps.

Is paying telstra, synergy, Alinta gas , western power also a cash advance or can I use my credit card

Hi Nicole,

Thanks for your inquiry.

If these falls under bill payments then typically they may be considered as cash advances. I suggest that you speak to your credit card provider directly to confirm whether the payments for the mentioned services or utility providers are considered as cash advances. You can also revisit your cardholder agreement with your credit card provider to learn more about their terms.

To know more which credit card transactions fall on cash advances, kindly refer to our guide on cash advances.

I hope this helps.

Cheers,

Debbie

Hi,

If my statement closes on say the 30th October and I owe $100 on my credit card which is due 15th November, if I pay the $100 off on the 10th November and then proceed to spend another $50 on my credit card that same day, is my balance considered cleared on the 15th November and that $50 goes to next months billing cycle or will I be charged interest on that new $50 now?

Hi Hayley, thanks for your inquiry!

To allow us to assist you further could you provide us with a specific bank please?

Cheers,

Jonathan

Hi Jonathan,

ANZ – Platinum rewards

Hi Hayley, thanks for your response.

Even if you had cleared your $100 outstanding balance, your entire balance (including the $50) would have to be cleared before your payment due date in order to receive interest-free days on your purchases.

I hope this helps.

Cheers,

Jonathan

Hi

Iv just got a mortgage and want to utilize a credit card with my monthly day to day spending so I can pay my weekly income straight off the mortgage. I then want to redraw from my mortgage to pay off my credit card each month.

Can I get a card which will allow me to make both purchases and cash withdrawals which will be interest free over a 1 month period?

Hi Ben,

Thanks for your inquiry.

Please refer to the following link for a list of 0% purchase cards. As of this time, there are no interest-free rates on cash advances, although there are low rate cash advance cards available.

You can press the “Go to Site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific questions. A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan

My question is:

If I paid in full one period, it supposes I am not going to be charged with interest for that period (which is reflected in my next statement). My bank charged me interest anyway the next period. I asked the bank and they replied that only if I pay in full every period I am not getting charged with interest.

Is that correct?

Thanks…

Maria

Hi Maria,

Thanks for your question.

This is correct. Only by paying your balance in full each month are you able to avoid interest on purchases each statement period.

Hope this has helped.

Thanks,

Elizabeth